“The most common idea associated with international trade is to find profitable products to export to the international market and make your profit selling at home. Load up a container, hand it over to KLANORIANS, and sell on Amazon or eBay and other online market places. There are many individuals who have set up Trade-agreement with KLANORIANS and are successfully selling their goods and making a good profit in UK European markets.”

ADD PRODUCT

PRIMARY STEP

Firstly Merchant of the company should provide us a significant Inventory and packaging list of your product along with a clear description and details about the product and also let us know any changes to the product description.

Your product and packaging list must include:

- Product description

- Individual product dimensions

- The Product’s Size & Weight

- HS code / Commodity code

- Market Retail Price

- Wholesale Price

- Desired Price

- Check UK Duties & Taxes

- Savings

PREREQUISITES

Make Sure Your Product Will Clear UK Customs

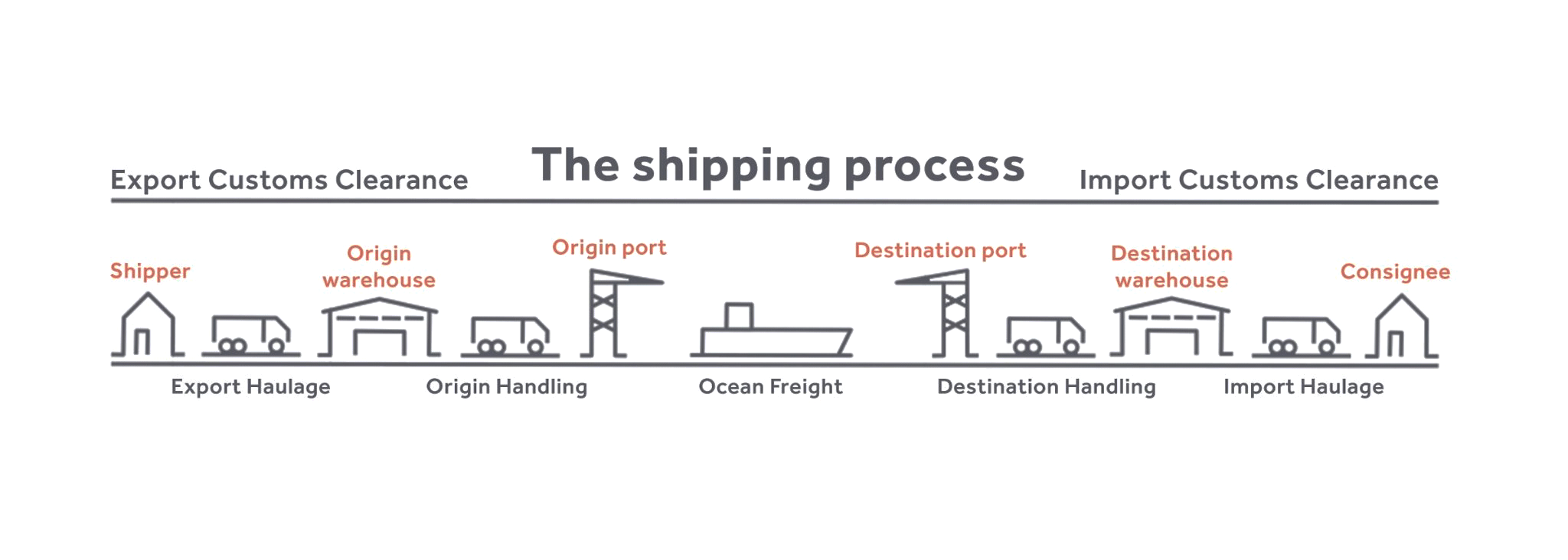

Import customs clearance

Import customs clearance can typically begin before the cargo arrives at its destination country. As for export customs clearance, it is a formality where a declaration is developed and submitted together with relevant documents enabling authorities to register and levy any customs duty on the shipment. Import customs clearance is performed by the KLANORIANS.

Destination handling

As for the origin, cargo handling is also required in the destination before it can be released to a consignee. In short, destination handling includes the transfer of the container from the ship to shore and from the port to the forwarder’s destination warehouse. It also includes un-stuffing the container and preparing the cargo for the consignee to collect.

Import haulage

The last leg of the transportation is the actual delivery of the cargo to our KLANORIANS Warehouse facility. It can either be performed by KLANORIANS or a local transportation company appointed by the KLANORIANS.

If this part of the transportation is being arranged by the shipper, it would normally make sense to use KLANORIANS freight forwarders which can also arrange for import haulage. The import haulage typically covers transportation to a specific address, but not unloading from the truck, which is the responsibility of KLANORIANS.

How to calculate your “After product landed costs”?

Although making an accurate calculation is complicated, it is a crucial step that should not be skipped when you export to the UK!

Desired costs should be implied on existing MRP or Wholesale price and basic volumes for your product, rather than the miscellaneous price that are sent to KLANORIANS

Profit:

The three types of charges will be implied on your product receipt and the final profit will be concluded after deducting SERVICE CHARGE, FULFILLMENT CHARGE, AND LOCAL TAXES.

Sale Example:

Your product original wholesale price = £5

FREIGHT CHARGES FROM YOUR DOOR TO KLANORIANS WAREHOUSE = £1.5 + £5

Now actual cost of the product is = £6.5

Your product desired price = £12

After-sale:

After deducting SERVICE CHARGE, FULFILLMENT CHARGE, AND INCOME TAXES on your desired price, you get = £6.5 + £2.5 = £9

So your product receipt gross profit = £3

As we are acting as a sub-office, KLANORIANS have to pay the income tax for the transactions made by you, the taxes only applied if your net income crosses the below band.

Income tax will be applied on the net profit you earn:

Band name

Name

Rate

Over £12,570* - £14,667

Starter Rate

19%

Over £14,667 - £25,296

Scottish Basic Rate

20%

Over £25,296 - £43,662

Intermediate Rate

21%

Over £43,662 - £150,000**

Higher Rate

41%

Over £150,000**

Top rated

46%

Final earnings will be transferred to you monthly with secure payment gateways

OVERVIEW